$790 million Ethereum options will expire today, providing speculators with the last opportunity to buy or sell Ethereum (ETH) at a predetermined price.

Previously, on May 23, a series of negative impacts influenced the market due to China’s promulgation of a prohibition on cryptocurrency mining and Elon musk’s announcement that it would no longer accept Ethereum (ETH) as a payment method. Ethereum fell to a minimum of $1,729 on May 23.

During the intraday, Ethereum was rebounding from the previous location to $2,665, an increase of 54%.

Ethereum options provide traders with a unique opportunity to buy or sell ETH at a set price. The price of an option contract will vary depending on the time of purchase, the strike price, and the day of expiry. An option’s exercise price is the price the underlying asset can either be bought or sold for.

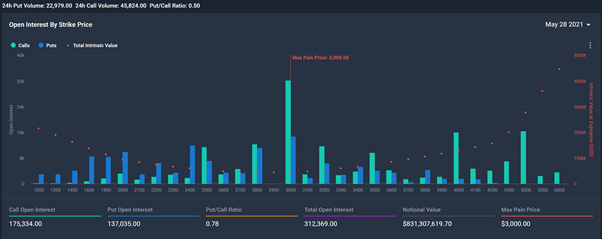

The figure above shows that the distribution of Ethereum(ETH) options that will expire on May 28. According to data from crypto derivatives exchange Deribit, the current “maximum pain price” that Ethereum will expire at is $3,000-still with a relatively long distance than the current trading price of $2,665.

The greatest pain point is the price at which the Ethereum options buyer loses the most in the market.

In other words, the maximum pain price will cause investors who previously purchased options to lose their time and opportunity cost of reinvestment of option premiums. This is the price that makes most options worthless because it is no different from buying or selling Ethereum on the public trading market. However, the option holders still need to pay for the option premiums to guarantee their spot.

As of the expiration date of May 28, there are 196,122.23 ETH call (buy) ether options against 155,475.64 ETH put (sell) options in open positions.

In general, the call/put ratio is 1.26 that greater than 1, which proves that there are still more bullish investors, having a 26% advantage.

However, investors must consider the following fact: It is not particularly desirable to have the right to buy Ether for $3,000 or more in less than 16 hours.

The strike price of most call options and put options on May 28 was around $3,000, which is a decisive level because there are 33.27 call options compared to 14.94K put options.

Around this level, a total of 960.5 ETH call options 771.4 ETH put options will expire.

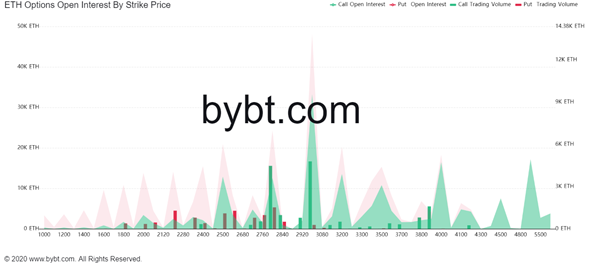

As shown in the above figure, many bearish investors with a large amount of open interest at an exercise price of around $2,800, and open interest has reached 11.79K ETH.

Open interest is the number of option contracts held by investors in all markets after the end of the previous trading day.

As the current price is moving around $2600, it seems that Ethereum bulls have no incentive to push the price above $3,000

Since the holders of the bullish contract who have accumulated Ethereum at a high strike price will most likely not exercise the option, if they chose to execute this option, these investors would buy Ethereum at a higher price, thereby pushing up the price.

Conversely, most of the bearish open interest is focused around $3,000 and $28,00, valued at 14.94K ETH and 11.79K ETH, respectively. There is also a high probability that bearish speculators will be willing to sell assets at this predetermined price to make profits.