Dogecoin has become one of the most popular cryptocurrencies, following a massive rally in the past few months. The support from popular figures such as Elon Musk has piqued people’s interest in the cryptocurrency. Hence, this allowed it to surpass Bitcoin for the first time in Google search.

Dogecoin’s Google search surpasses that of Bitcoin

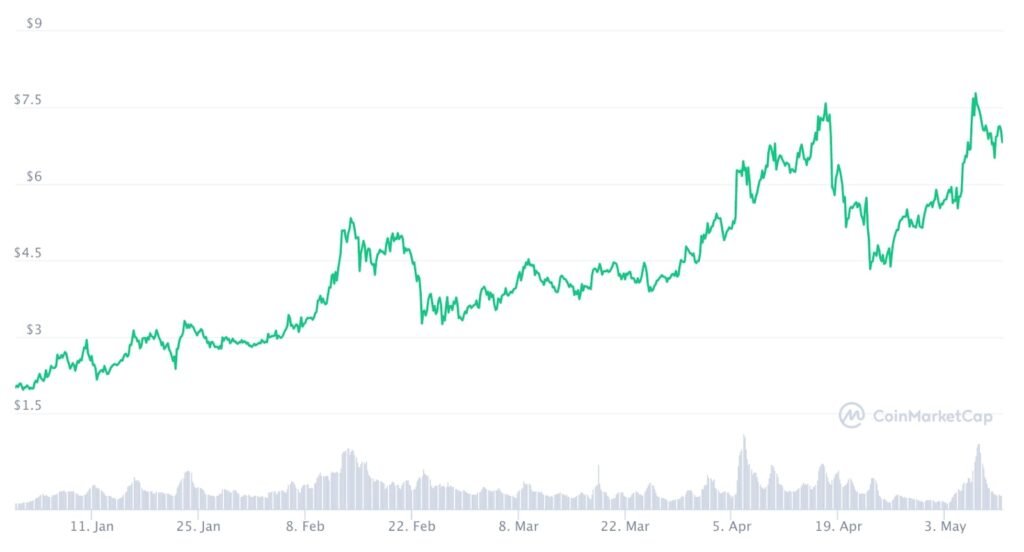

Global interest in Dogecoin has been massive in recent months. The interest came from its rally which saw a rise by over 5,000% in the past few weeks. The interest in the cryptocurrency is measured by search engine statistics, and it has surpassed Bitcoin in this area for the first time.

According to Google trends, Dogecoin’s searches are higher than Bitcoin’s at the moment. From May 2nd May 8th, Dogecoin had a 100 score on Google Trends, while Bitcoin scored 55/100 within the same period.

This comes after a dramatic rise in price and popularity for Dogecoin. Last month, DOGE gained 80% in value in a single day, and its year-to-date return is over 5,000%. Its rally saw it overtake several cryptocurrencies in terms of market cap and it is now the fourth-largest cryptocurrency in the world.

Dogecoin underperforms despite the recent increase in interest

Despite the rise in interest in the cryptocurrency, Dogecoin has underperformed in the past few days. It dropped from its all-time high above $0.7 this weekend despite Elon Musk mentioning the cryptocurrency on Saturday Night Live. At the moment, DOGE is trading at $0.50, down by 1.66% over the past 24 hours.