Our target timeline is 1 to 6 weeks per token.

This token we are investing in is not yet available on the market but is opening up eligibility for an airdrop.

In this report we break down this particular project, the economic model of its token and how to become eligible for the airdrop.

This investment is not particularly based off of strong fundamentals or future intrinsic value. These are hype-trains we are onboarding, many of which are frankly sh*tcoins we believe can see a lot of momentum.

Given the risky nature of hype-speculation, we’ve managed our risk by setting aside capital specifically for that purpose – capital we can fully afford to lose.

We’d like to stress the fact that this report does NOT constitute financial advice under any circumstance, we are simply sharing our research and approach to investments for educational purposes.

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

Introduction

Solanium is a decentralised platform built on the Solana blockchain with the purpose of introducing decentralised fundraising, time-weighted token staking and governance voting to the Solana ecosystem.

Solanium is focusing on improving Solana user experience (UX) by implementing an easy-to-use, easy to understand user interface (UI). Their team believes that one of the issues holding back the Solana ecosystem is UX – we’ve seen that issue first hand with two IDOs that we participated in and therefore think this is a fair statement.

Let’s have a brief look at the proposals Solanium is putting forward.

SLIM Token

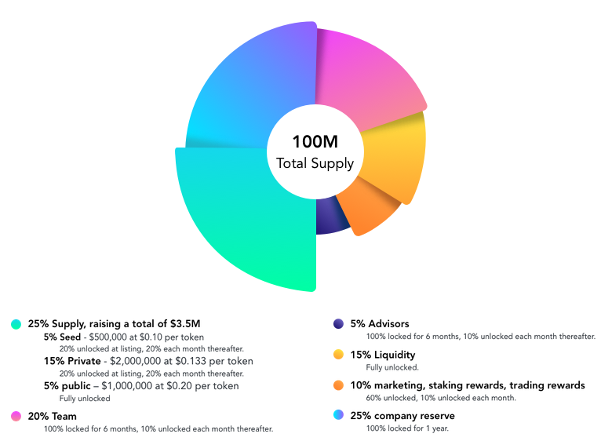

The SLIM token is a Solana Program Library (SPL) token with a total supply of 100,000,000 SLIM, distributed as follows:

The SLIM token will have several functions within the Solanium platform.

Staking

SLIM tokens can be locked up for up to a year – users will receive an xSLIM token balance, which is not transferrable:

- xSLIM tokens grant the holder rights to a portion of the fees generated by the Solanium ecosystem, as well as voting rights and exclusive/early access to pools (pre-sales).

- xSLIM balance is proportional to the quantity of SLIM tokens originally locked – the xSLIM balance linearly decreases with time and will eventually hit zero once the original locking period selected is over and SLIM tokens are unlocked.

- SLIM tokens locked cannot be withdrawn before the lock period is over, however an extension to the locking time is possible; as is the quantity of SLIM locked.

Governance

The xSLIM token acquired by staking SLIM will act as the governance token of the Solanium network, and as previously stated, will provide holders with voting rights.

At the start, the governance mechanism will be partially centralised. Tokens are in the hand of the community members and investors and each xSLIM token will have equal weight so that part if decentralised. However, votes will be done through a centralised application that will maintain the vote counts and details on its database – this part is centralised.

Over time, the voting process will be taken on-chain to fully decentralise Solanium.

Decentralised Fundraising

One of the main functions will be the Solanium pools:

- Solanium eases the process of creating SPL tokens and getting them live through pools.

- Through Solanium, users will be able to create their own sub-UI for participants of their pool to interact with and act as a sort of branded front-end/landing page.

- Solanium pools will be opened to xSLIM token holders before they get opened to the general public. Each xSLIM holder will be able to invest before the general crowd based on their holdings.

- Each pool will pay a percentage of fees to xSLIM holders and the Solanium Governance Treasury.

Trading

One of the first phases of the Solanium project will be the implementation of a custom graphical user interface (GUI) for the Serum DEX. Their goal with this “Trading” interface is to bring forward the front-end that users are used to on centralised exchanges – that plays a role in improving UX.

Our personal opinion though, is that “SWAP” functions like we see on Raydium or Uniswap/Sushiswap are a lot more user-friendly.

SLIM: A Sh*tcoin?

Solanium is a bit all over the place at the moment. They are sort of recreating another Raydium but keeping the trading part fixed to a centralised orderbook (like Serum) instead of having a SWAP-ing mechanism.

The information they are sharing is not fully clear about their end-goal.

Usually, projects can be cryptic pre-launch but when they are making announcements they need to be straight to the point to communicate their vision, not beat around the bush without reaching a single conclusion. They also seem to be rushing the launch of their token, we speculate it is mainly because they want to capitalise on the hype – like us (but we are traders and doing that is fine, as a project it is unethical).

The last part is: they claim to be a fair launch platform which is DeFi ethos but want to start with a centralised governance process?

To conclude, the current evidence points towards SLIM being a sh*tcoin, but one that will probably pump during Solana SZN and hence we will allocate some funds to it.

Let’s explore the PUMPonomics.

SLIM Economic Model

From a game theory perspective, here is how Solanium has built SLIM to be “pump-friendly” (if Solanium ends up being a legit project, we apologise in advance – forgive us).

People want to enter “fair” pre-sales and owning SLIM tokens achieves it, that is where the demand comes from. But to enter those pre-sales, users must stake SLIM (which then gets turned into non-transferrable and time-locked xSLIM tokens) and hence that reduces the supply available to be bought.

SLIM will also launch at $0.20 per token which is attractive to “new entrants”.

These are decent PUMPonomics.

Adding in the time-locks means there will be supply shocks on unlocks along the way as well – something we’ll cover once more information is shared. But to be upfront, we will look to lock/stake tokens for as little time as possible or else we may become SLIM bagholders.

Public Sale Whitelist

The public sale is NOT yet happening but they are opening the doors for an airdrop where users can simply connect their wallets on: Solanium.io and whitelist their address for both an airdrop and eligibility to the public sale (unknown release date).

The public sale whitelist will start on 1PM BST, Friday 7th May. All participants will be eligible for 1 airdrop ticket, as well as whitelisted for the public sale – the timing of that has yet to be announced.

That is something we will be participating in through multiple Solana addresses since there’s no risk in being eligible for an airdrop and extra allocations later on for the public sale. Airdrops are a risk-free play here but we do believe a lot of people will try entering with multiple wallets so we don’t expect the airdrop to be anything significant – it’s a “sure why not” entry.

When Solanium releases more details we will update this report with details of the public sale, how we’re entering, how much we’re allocating and where we think SLIM is headed price-wise.