After calling the Dogecoin mania the “ultimate gamble trade,” Barry Silbert predicted DOGE’s market cap will go below $1B as it’s not worth $37B.

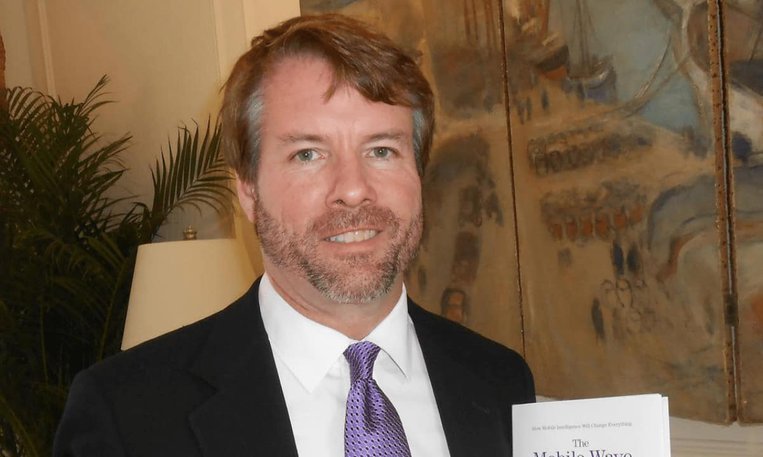

Barry Silbert, the Founder and CEO of Digital Currency Group, believes Dogecoin is not worth $37 billion and predicted a significant drop in its value to below $1 billion. Nevertheless, the former Grayscale CEO added that DOGE will “certainly” not go away due to its passionate community.

DOGE is Not Worth $37B

Despite seeing the light of day in late 2013, the Shiba Inu-inspired meme coin became a real star eight years later following constant social support from Tesla’s Elon Musk, mimicked by multiple other celebrities.

The rapidly appreciating price led to numerous copycats but also garnered the attention of retail investors and even mass media. People rushed to cover the next hot topic coming out of the cryptocurrency world.

However, quite a few argued that the skyrocketing price and coming just $0.25 away from reaching $1 is a clear sign of a bubble state. Barry Silbert, the man behind Digital Currency Group, seems to be among those.

In a recent Twitter chat, the executive said he’s “truly excited to see what DOGE can become over time” and predicted that it’s not going away. However, he added, “it is not worth $37 billion,” which is the meme coin’s total market cap at the time of this writing.

It’s worth noting that Silber also predicted a violent crash for DOGE by indicating, “it’s going back to sub $1 billion.” If his words indeed come to life, Dogecoin’s price would plummet well below $0,01.

The Ultimate Gamble Trade

After highlighting his adverse future price views about the meme coin, Silbert broached his reasons. He called Dogecoin the “ultimate momentum, gamble trade.”

Consequently, he believes that once this momentum is gone, which could be closer than most people expect, the current holders will move from DOGE to other hot coins. By doing so, they will “learn there are many other/better ways to make 10x” returns.

“If the entire value of something comes from a collective belief – and not usefulness or utility – then that thing is overvalued. There’s another name for that, but I’m not going there as I know it wasn’t created for that purpose or why most people loved it early on (like me).” – Silbert concluded.