🧬 So, what is Raydium?

Raydium is an automated market maker (AMM) built on the Solana blockchain which leverages the central order book of the Serum decentralized exchange (DEX) to enable lightning-fast trades, shared liquidity and new features for earning yield.

👽 Why is Raydium different?

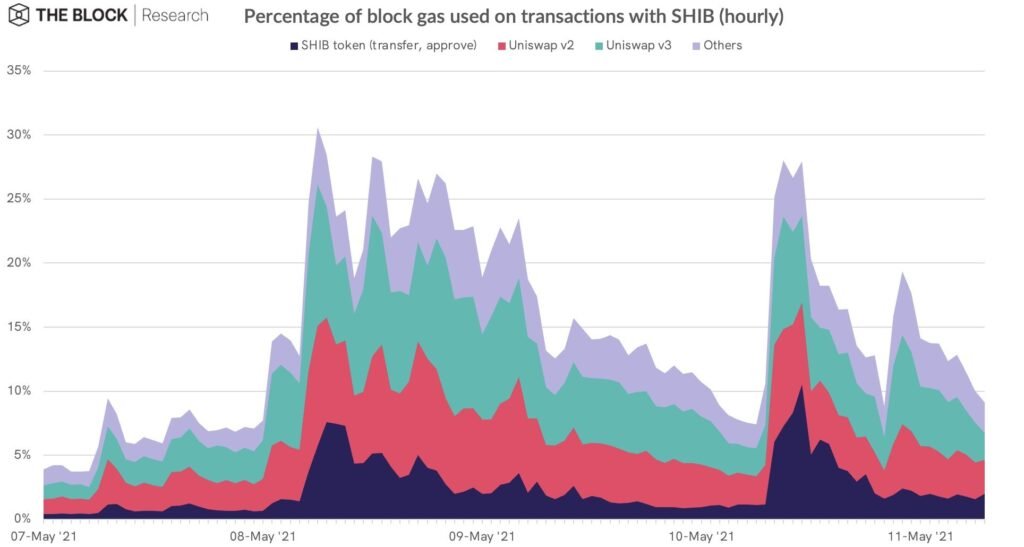

Other AMM DEXs and DeFi protocols are only able to access liquidity within their own pools and have no access to a central order book. Additionally, with the majority of platforms running on Ethereum, transactions are slow and gas fees are high.

Raydium offers a few key advantages:

- Faster and cheaper: We leverage the efficiency of the Solana blockchain to achieve transactions magnitudes faster than Ethereum and gas fees which are a fraction of the cost.

- A central order book for ecosystem-wide liquidity: Raydium provides on-chain liquidity to the central limit order book of the Serum DEX, meaning that Raydium allows access to the order flow and liquidity of the entire Serum ecosystem.

- Trading interface: For traders who want to be able to view TradingView charts, set limit orders and have more control over their trading.

🧐 What can I do on Raydium?

Trade and swap

Raydium’s swap feature allows two tokens to be exchanged quickly through Serum, while the DEX UI also allows for more advanced trading features such as limit orders. These make for a better trading experience for users.

Earn RAY

There are a number of ways to earn RAY tokens while farming liquidity pools and staking. More features are on the way!

Power your project with Raydium!

If you’re looking to launch your project on the Serum DEX or build out and supercharge features of your platform on Solana, Raydium can help and would love to talk partnership!

Raydium Token can reach up to $90 until the end of Q2!

Read more

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results. Past performance is no guarantee of future results